Lending made faster, smarter, and simpler

Whether you focus on residential or specialist lending, Finova Lending offers a tailor-made originations platform to fit your needs. Choose our award-winning whole-market solution (formerly Apprivo) or MSO, the UK’s most trusted retail lending platform.

A knowledgeable partner with a great understanding of our market

“Finova's cloud-based originations platform is a true asset that will help us scale at pace.”

We were very impressed with Finova

“The new system is a step-change for us. It will help further improve the experience for demanding customers and brokers with complex needs, and keep us at the forefront of our market.”

Great for efficiency. Greater for users

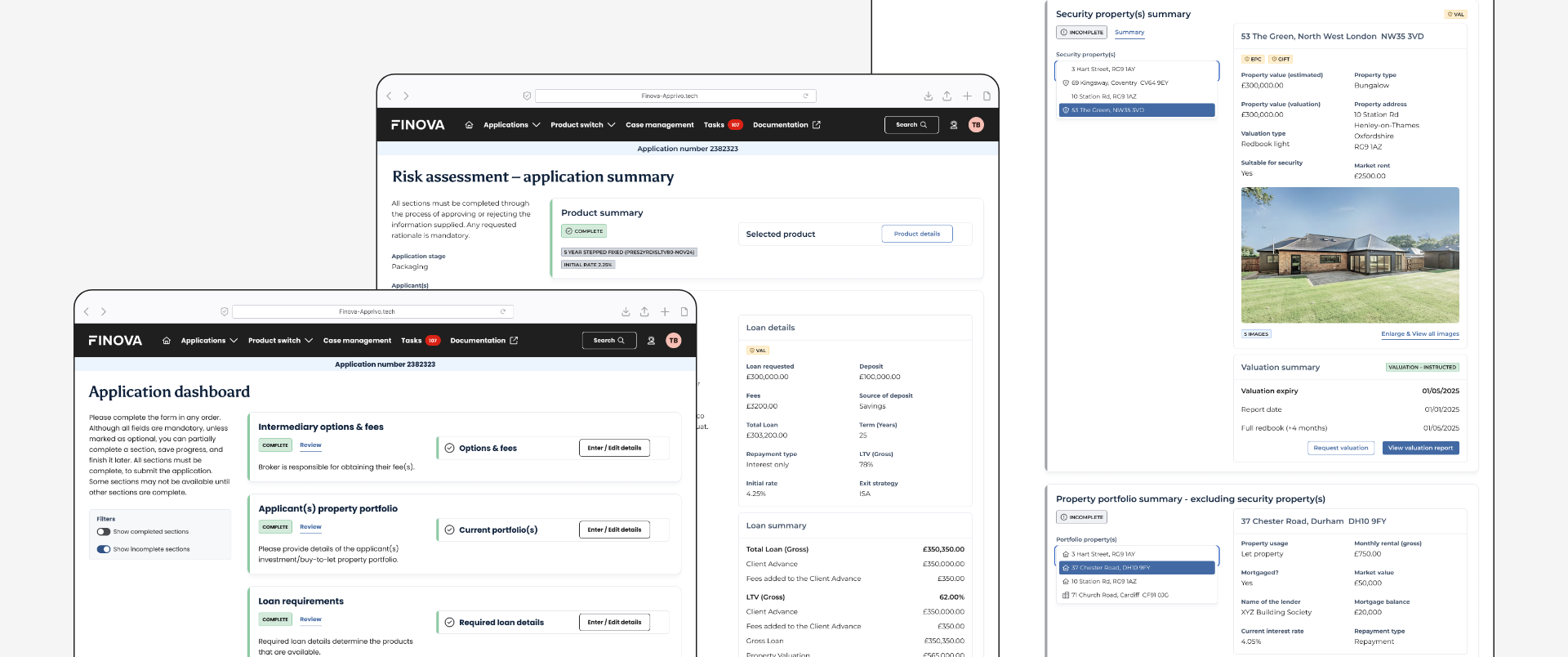

Finova Lending gives you the tools to deliver faster onboarding, smarter decisioning, and seamless, personalised journeys — all without adding complexity.

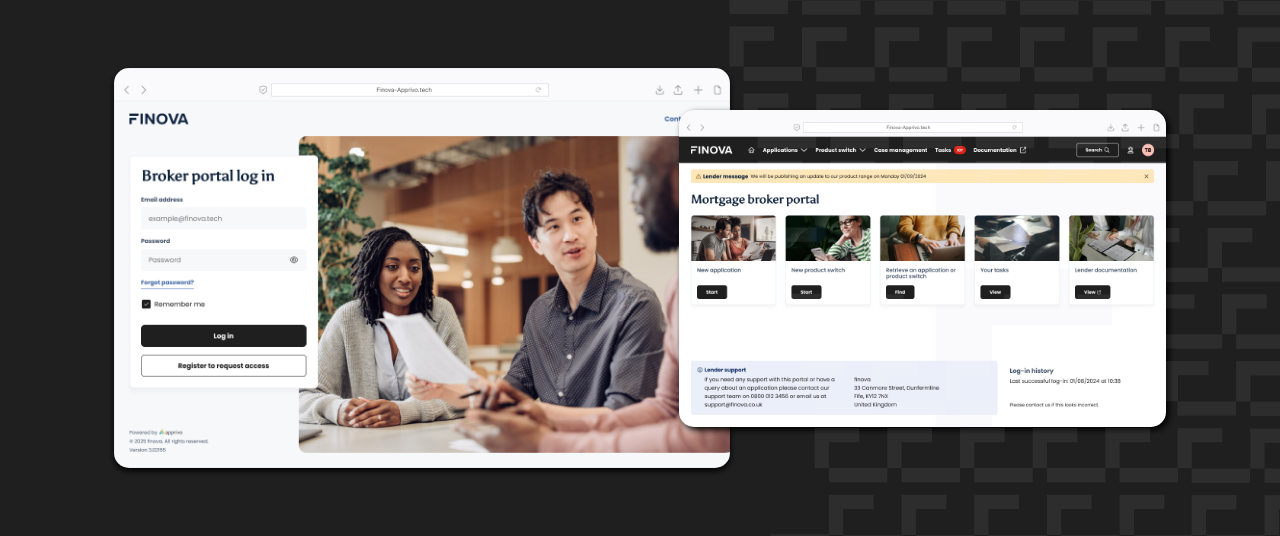

Bespoke customer journeys

Greater personalisation = higher acceptance rates. Alongside tools for designing more relevant lending products, our platform also has purpose-built user journeys for bringing in new customers and retaining existing ones.

Comprehensive integrations

Connect to credit referencing agencies, property valuation services, and other databases. Finova can also access AI-powered analytics, automated affordability models, and dynamic risk pricing, for more accurate, personalised decisioning.

Rapid deployment

Launch a custom instance in under 6 months, or use Finova Lending off the shelf for even quicker deployment. You'll also benefit from regular system upgrades, enterprise-grade security, and guaranteed 99.99% uptime.

No-code customisation

Endless configurability, minimal effort. Drag and drop menus make customisation quick and intuitive, even if you're not a technical person. Have more advanced requirements? Our in-house experts can build them for you.

The most successful project we've been involved with

“The Finova team has been exceptionally professional, showing flexibility and dedication throughout the journey. We’re delighted to now have a recognised and trusted platform that gives us the confidence to grow our business while maintaining exceptional service.”

A natural fit

“Customer expectations have changed. Many borrowers want to research the market themselves, choose a product that meets their needs, and be able to self-serve at a time convenient to them. Finova Lending allows them to do that.”

Give customers more of what they want, and staff less of what they don't

Find out how Finova Lending can clear operational bottlenecks and boost your lending business.