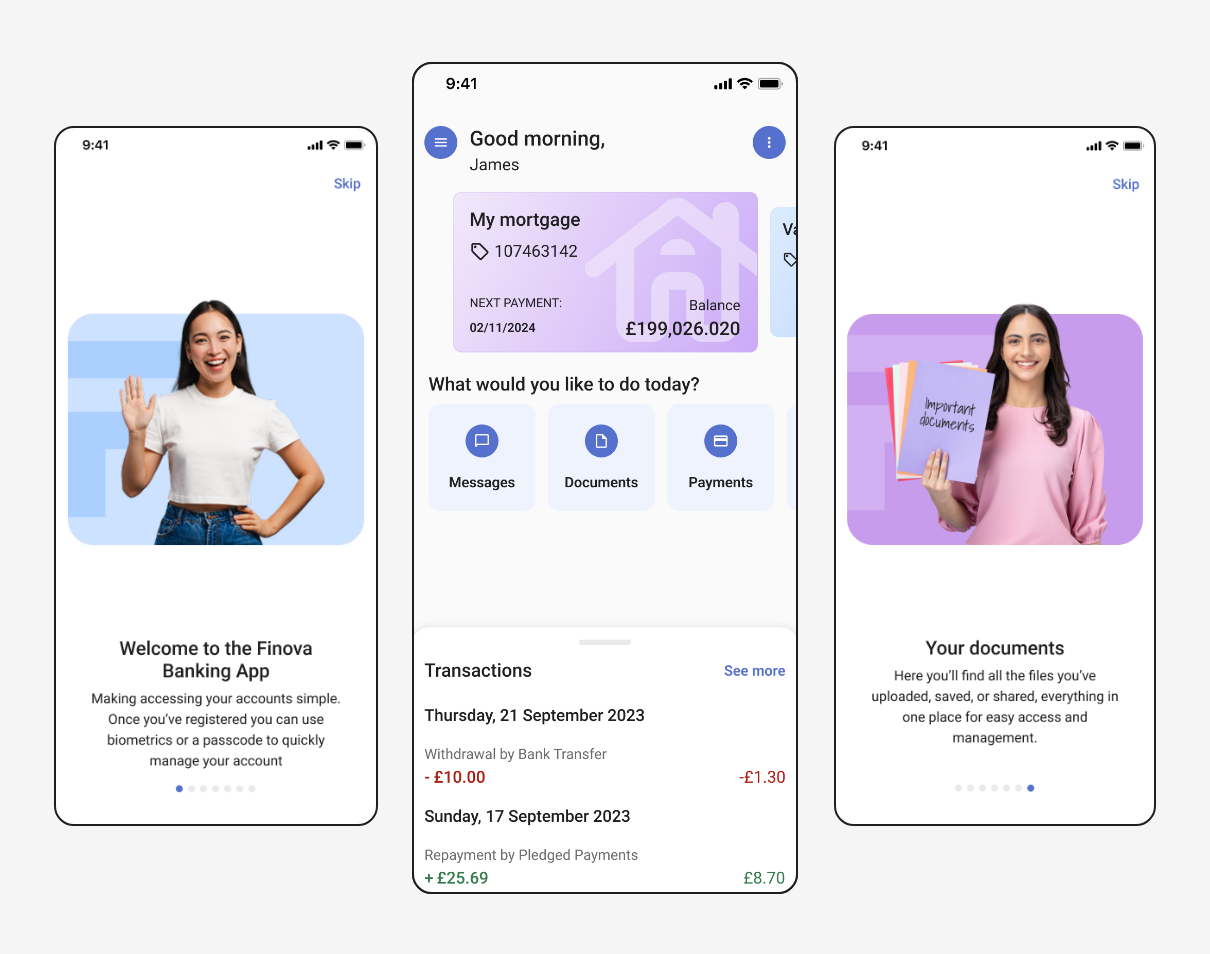

Your mobile app.

Powered by Finova.

Reduce your operational costs with a powerful white-label solution.

Today’s customers expect 24/7 access to their mortgage and savings accounts — and they expect it to be fast, secure, and mobile-first. With Finova’s mobile app solution, you can launch a fully branded digital experience in weeks, not months — without draining your development budget or internal resources.

Mobile banking with a human touch

Whether you offer mortgages, savings products, or both — Finova’s white-label app is built to deliver a seamless, intuitive digital experience.

A white-label experience

Go to market with a fully custom branded mobile appLaunch a fully custom-branded app that reflects your look and feel — no build-from-scratch delays.

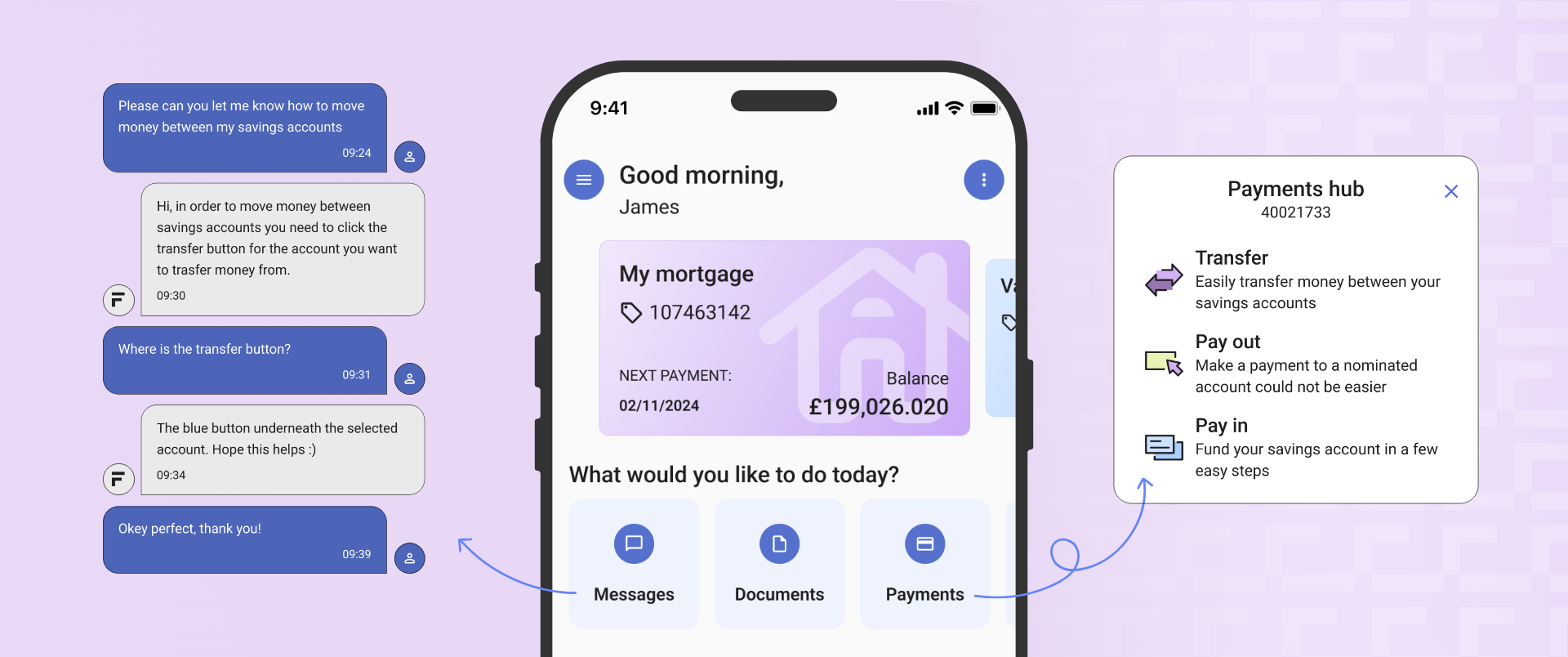

Secure messaging

Give your customers alternative display setting optionsStay connected with customers via in-app, threaded conversations — all fully secure and compliant.

Light or dark mode

Offer display options that adapt to your customers' preferences and devices.

Open banking

Allow seamless connectivity to third party banks via open bankingEnable seamless integration with third-party banks to give your users a fuller financial view.

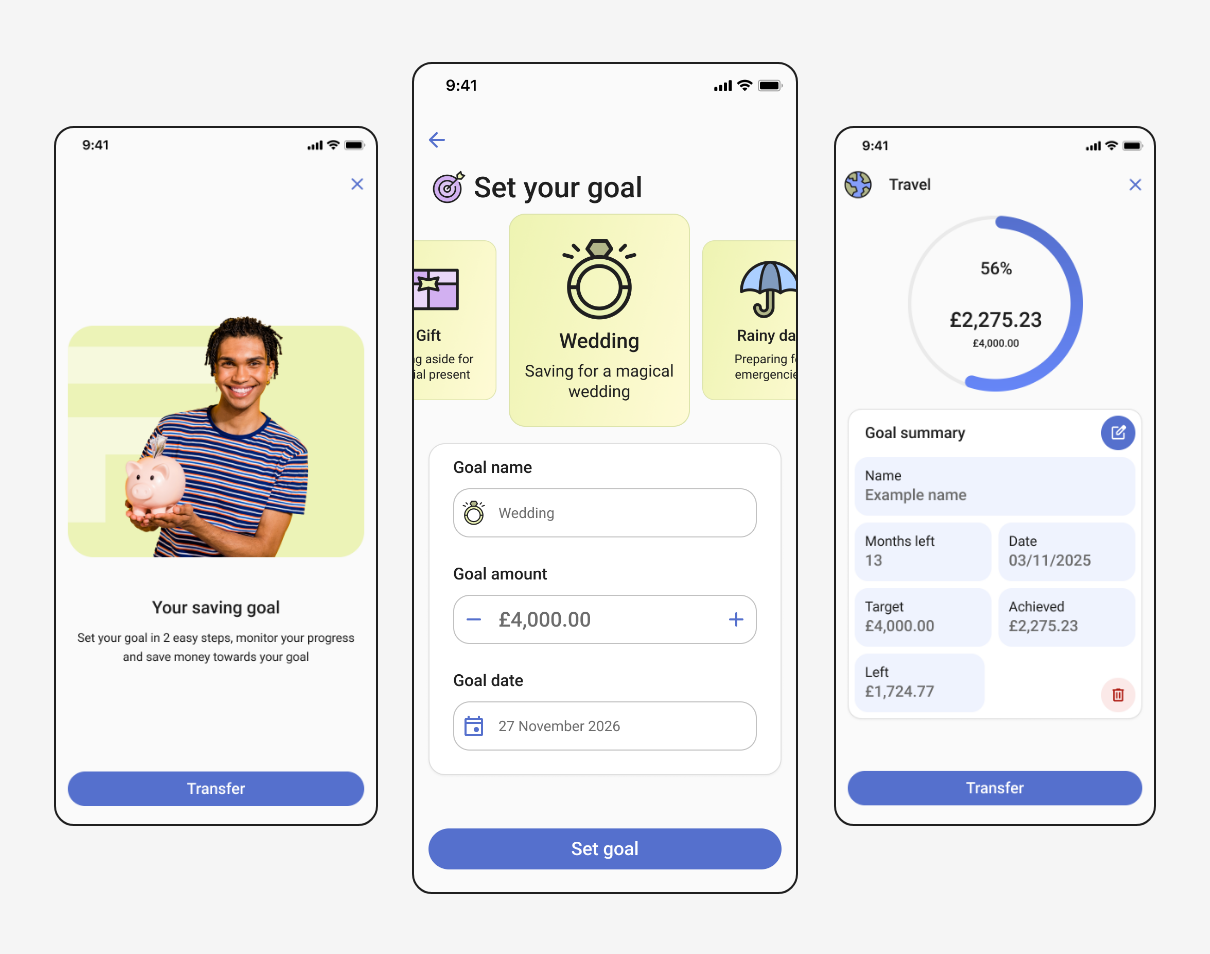

Tailored features for every journey

Why now? The stats speak for themselves

rank higher than local branches in importance to UK consumers.

own a smartphone, with average screen time approaching 4 hours per day.

Ready to launch your mobile app?

See how Finova can help you go live — fast, securely, and with no compromise on experience.