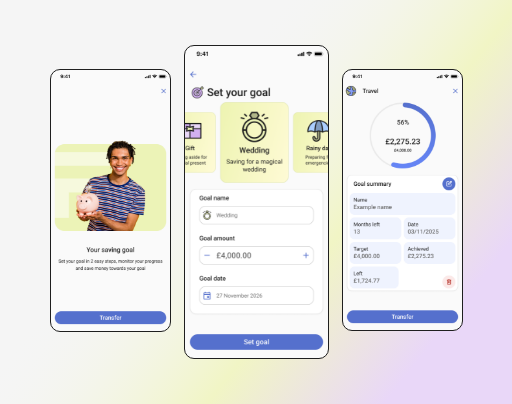

Put customers in charge of their savings journey

Launch market-leading, digital-first savings products customers love, without unsustainable IT budget or headcount increases.

Finova have transformed our business

“They've enhanced our ability to provide our customers with a better experience, and elevate our ability to fulfil our purpose. With them by our side, the future is looking brighter than ever.”

For savers of all shapes and sizes

Whether they’re saving for a first home, a rainy day, or their business’s future, Finova makes it easy to serve every kind of saver — on their terms.

Comprehensive product lineup

Cater to every customer segment and type imaginable: retail savers, including joint accounts and children's products, and business savers — limited companies, partnerships, and sole traders.

Multi-channel support

Meet your customers where they are. Our solution includes native iOS and Android mobile apps and a web portal, as well as terminals for staff who serve customers face-to-face, via live chat, or over the phone.

Value-added features

Make it as easy as possible for your customers to control what personal data they share, and to set savings goals, open additional accounts, set maturity instructions, and more. All with a few swipes on their phones.

Personalisation engine

Segment your customers by type and life stage, and send targeted, timely notifications and communications that keep them in the loop and support them on their savings journey.

Plug into Finova Savings, and bring your customers closer to their financial goals

Let's show you how our intuitive, digital-first solution can help you make it happen.